Job chhodne yaa Retire hone ke baad kisi ki bhi sabse badi poonji uska PF hota hai. Aaj ham jaante hain ki Job chhodne ke baad PF ka paisa kaise nikala jaa saktaa hai. PF Nikalne ka aavedan karne ke liye Aavedak Retire hona chahiye yaa kahin Job nahin kar raha hona chahiye. Job chhodne ke ek Mahine baad aap 75% PF aur baaki 25% Do mahinon ke baad nikaal sakte hain. Iske liye aapko PF Form Download karke office mein jamaa karana hoga yaa phir aap online PF nikal saktein hain.

Ghar baithe nikal sakte hain paise:-

Sarkar jald hi PF khatadharakon ke account Mein byaj Interest daal sakti hain. Lekin aap PF khate se bank account ki tarah paise ki nikasi nahi kar sakte hain. (EPFO) kuchh sharton ke saath PF account se paise nikalne ki anumati deta hai. Halanki, Aap aasani se ghar baithe hi PF ka paisa nikal sakte hain. EPFO ke mutabik online sirf 72 ghante Mein paise nikal sakte hain.

PF se paise nikalane ki shartein:-

- PF se pura paisa do hi sharton par nikala jaa sakta hai, pehla aapka retirement ho chuka ho aur dusra aap berojgaar hon. Dhyaan rahe EPFO 55 saal se jyada ki umar vaalo ko hi retirement ki umar maanta hai. Retiremenṭ se ek saal pehle tak aapko sirf 90 % raashi hi nikalne ki anumati hogi.

- Berojgari ke ek mahine baad bhi aap sirf 75 % hi rashi nikaal sakte hain. Bakaya rashi ko naye rojgaar milne par aapke naye EPF khaate mein ṭransfer kar diya jayega.

- Yadi karmachari 5 saalon tak nirantar seva mein hai, to vo ghar ke nirmaaṇ yaa kharid ke liye rashi nikal sakta hai. Vahin home loan ke liye karmachari ko kam se kam 3 saal tak seva mein hona jaruri hai. Aise mein vo 90 % tak rashi nikal sakta hai. Shaadi jaisi jarurat ke liye karmachari ko 7 saal tak seva mein hona jaruri hai. Aise mein woh apni jama rashi ka 50 % tak nikal sakte hai. Meḍical upchar ke liye koi shart nahi hai.

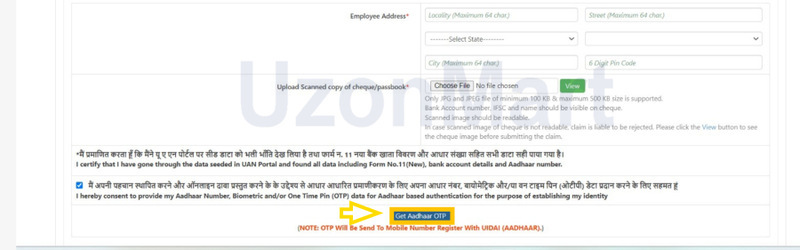

- EPF ka paisa nikalne ke liye aap UAN aur Aadhaar ko apne EPF Ac se jodkar online claim kar sakte hain. Iske liye aapke paas active UAN number, Bank Ac jo UAN ke saath link ho aur Pan card aur Aadhaar sambandhi jaankari honi chahiye, jo EPF Ac se jude hone chahiye.

PF Withdrawal: Zaruri Dastavej:-

PF khate se paisa nikalne ke liye Nimnalikhit Dastavej hone chahiye:-

- Composite Claim Form.

- Do Revenue Stamp

- Bank Ac Statement (PF Dhaarak ke jeevit hone par bank ac keval usi ke naam par hona chahiye)

- Pehchaan Patr

- Pata Pramaan Patr

- Ek Cancel Blank Check jismein AC number aur IFSC code ho.

- Vyaktigat jaankari jaise ki, pitaa kaa naam, janmatithi aadi pehchan patr ki jaankari se mel khati ho.

- Agar karmachari job ke paanch varsh pure hone se pehle PF rashi nikalta hai to use ITR form 2 aur 3 bhi lagana hoga.

PF Ac se paise nikalne par kitna lagega Tax?

PF Ac se rashi nikalne par Tax nahin dena hota hai, lekin uske liye kuch sharte hain jo niche di gayi hai:-

|

PF Rashi Nikalne ka samay |

Tax ke Niyam |

|

Agar karmachari Naukri ke 5 varsh poore hone se pehle PF khate se 50,000 Rs se jyada rashi nikalta hai. |

Agar karmachari apna pan number deta hai toh use 10% TDS chukana hoga. Pan number naa Dene per TDS 30% hogi or TDS ke saath tax bhi kata jayega. Agar karmachari form 15G/15H submit karta hai to koi TDS nahin kata jata hai. |

|

Agar karmachari Naukri ke 5 varsh pure hone ke baad PF rashi nikalta hai. |

Koi TDS lagoo nahin, chunke is tarah ke withdrawal par Puri tarah se chhut hai. Isliye karmachariyon ko apne ITR mein bhi ise dikhaane Ki jarurat nahin hai. |

|

Agar koi karmachari apni PF rashi “Rashtriya Pension Yojana” Mein transfer karta hai. |

Koi TDS lagoo nahin hoga. |

PF account se online aise nikal sakte hain paisa:-

Step 1:- Sabse pehle EPFO ke “Member Portal” par jayen.

(https://www.epfindia.gov.in/site_en/index.php).

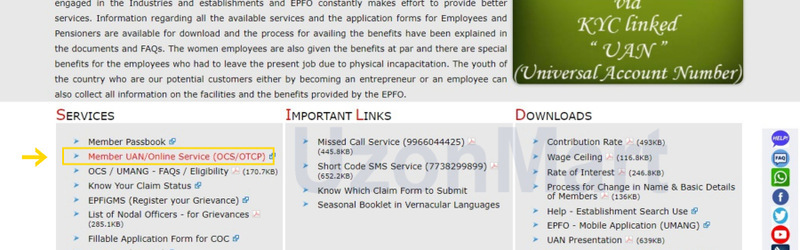

Step 2:- Menu main “Services” ke option, click Kare.

Step 3:- Aapko “For Employees” per click karna hoga.

Step 4:- Iske baad Naya page open hoga.

Step 5:- Yahan Member UAN / Online Service (OCS/ OTCP) ko chune.

Step 6:- Iske baad “login page” khulega.

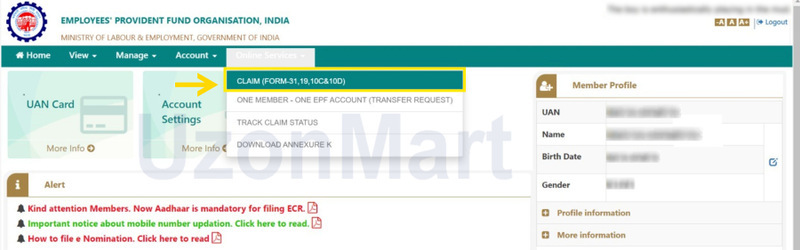

Step 7:- Yahan UAN or Password ki madad se login Kare.

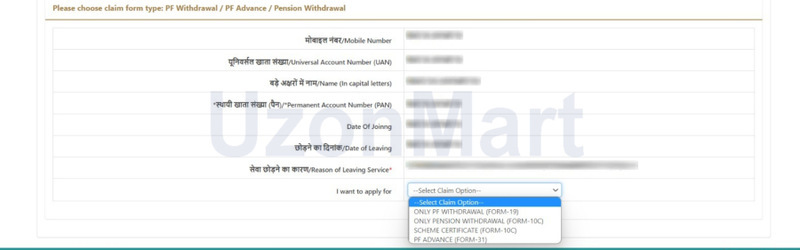

Step 8:- New page per “Online Services” per Jayen. Drop Down menu se “Claim (FORM-31, 19 & 10C & 10D)” ko chune.

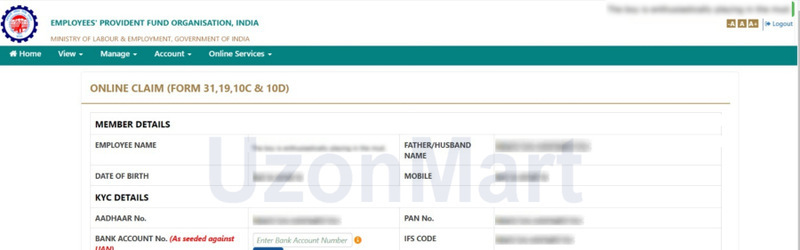

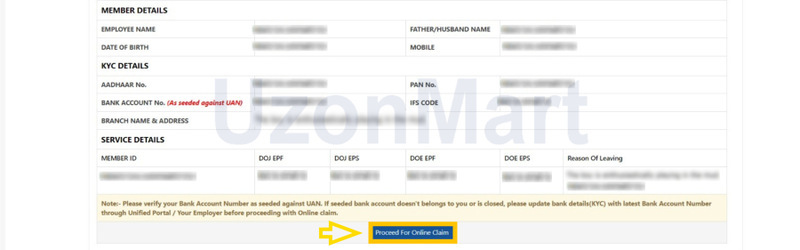

Step 9:- Ab “New Page” khulega, Jahan aapko Bank account number verify karna hoga.

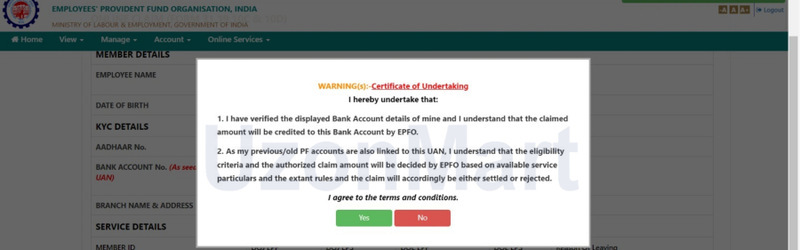

Step 10:- Verification ke baad “Certificate of Undertaking” khulega, jise accept karna hoga.

Step 11:- “Proceed For Online Claim” option par click kare.

Step 12:- Ab ek form khulega. Yahan "I want to apply for" ke saamne drop-down se "PF ADVANCE (FORM - 31)" select kare.

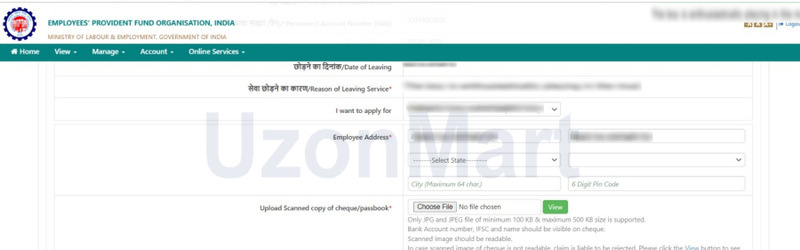

Step 13:- Yahan aap se “Paise Nikalne ka” kaaran aur “Zarurat ki Raashi” puchi jaayegi.

Step 14:- “Checkbox” mark karte hi process pura ho jaata hai. PF Claim Form jama hone ke 5 se 7 dino ke andar Bank Ac me paisa jama kar diya jaata hai.

PF account se offline paise nikale:-

Apni PF rashi nikalne ke liye, aap sambandhit EPFO office mein jaa sakte hain aur Composite Claim form jama kar sakte hain. Composite Claim form Do Prakar ke hote hain Aadhaar or Gair aadhaar. Aadhar form ko Niyokta/Company se attach karane Ki jarurat nahin hoti hai, Vahin Agar aap Gair aadhaar form ka upyog kar rahe hai, to aapko apne adhikar kshetra vale EPFO office mein jama karne se pehle apne Niyokta/Company se ise attach karna hoga.

Pehle EPF nikalne ke liye Form 19 Form 31 or Form 10 C jaise dastavejon ki jarurat padti thi. Halanki, ab in dastavejon ki jagah ek hi EPF withdrawal form jise Composite Claim Form kehte hai, ko submit karana hota hai.